flow through entity irs

A flow-through entity is an entity through which income flows to the owners or investors without being subject to taxation at the entity level. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity.

4 Types Of Business Structures And Their Tax Implications Netsuite

There are two major reasons why owners choose a flow-through entity.

. Tax advantages The entitys income only goes through a single layer of tax rather than two. Income that is or is deemed to be effectively connected with the conduct of a US. The Michigan flow-through entity tax is enacted for tax years beginning on and after January 1 2021.

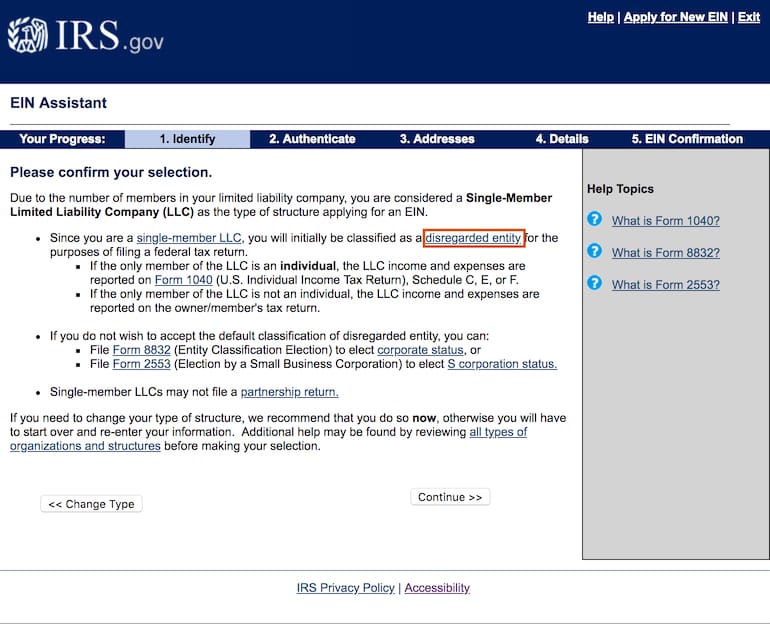

That is the income of the entity is treated as the income of the investors or owners. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. All of the following are flow-through entities.

Trade or business of a flow-through entity is treated as paid to the entity. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated.

A flow-through entity is also called a pass-through entity. Is designed to fulfill the scope and intended purpose of ensuring that tax on income is paid only once-collecting the same amount of income tax from the business entity as would otherwise. Withholding agent makes a payment of portfolio interest described in section 871h to an account maintained by a nonparticipating FFI the payment will be subject.

However the late filing of 2021 FTE returns will be accepted as. For example if a US. Its gains and losses are allocated.

Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. A flow-through entity FTE is a legal entity where income flows through to investors or owners. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

All payments under the flow-through. About Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Income that is or is deemed to be effectively connected with the conduct of a.

Branches for United States Tax Withholding and Reporting This form may. As a result only the individuals not the business are taxed. A legitimate business entity that passes income to owners or investors of the business is a flow-Through entity.

This rule applies for purposes of NRA withholding and for Form 1099 reporting and backup withholding. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. Branches for United States Tax Withholding provided by a foreign.

What is a flow-through entity. Per the MI website this tax allow s certain flow-through entities to elect to file a return. The most common type of flow-through entity is.

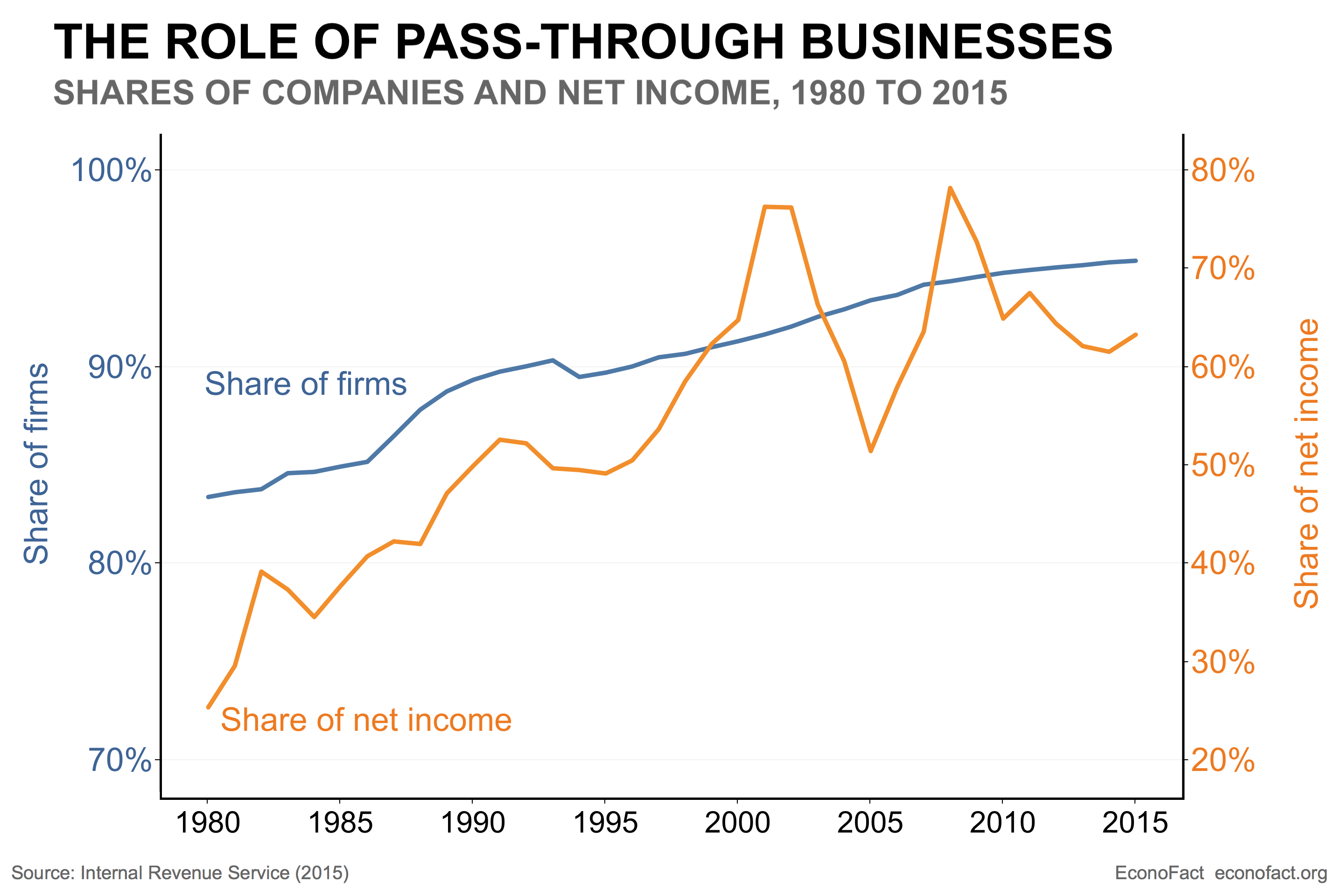

A foreign partnership other than a withholding foreign partnership See more. As enacted this tax is retroactive to tax years beginning on or after January 1 2021 for flow-through entities that make a valid election. Most small businessesand quite a few larger onesare set up as pass-through entities.

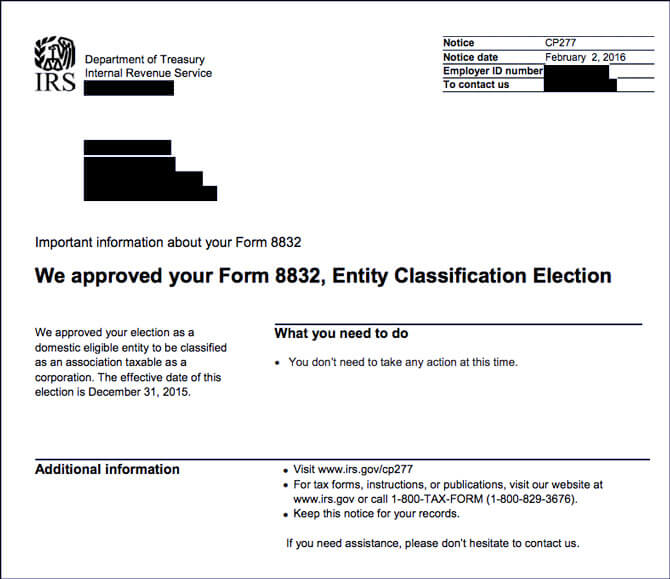

This disconnect between receipt of cash and. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

9 Facts About Pass Through Businesses

Irs Issues Faq Guidance And Additional Relief For Pass Through Entity Returns

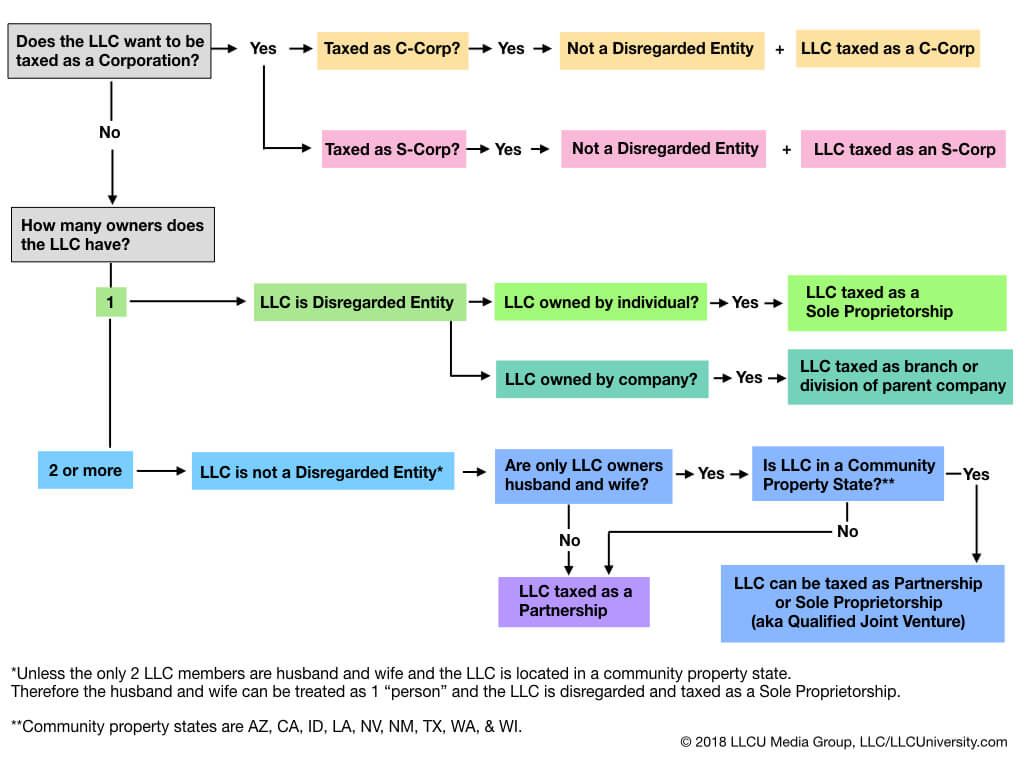

What Is A Disregarded Entity Llc Llc University

What Are Pass Through Businesses Tax Policy Center

Irs Allows Use Of Pass Through Business Alternative Taxes To Bypass 2017 Tax Act S Limitation On Salt Deductions Effectively Blessing New Jersey Statutory Work Around Gibbons Law Alert

Pass Through Entity Tax 101 Baker Tilly

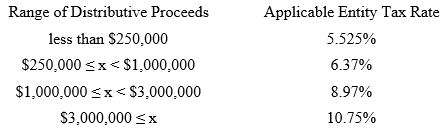

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

The Other 95 Taxes On Pass Through Businesses Econofact

Doing Business In The United States Federal Tax Issues Pwc

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

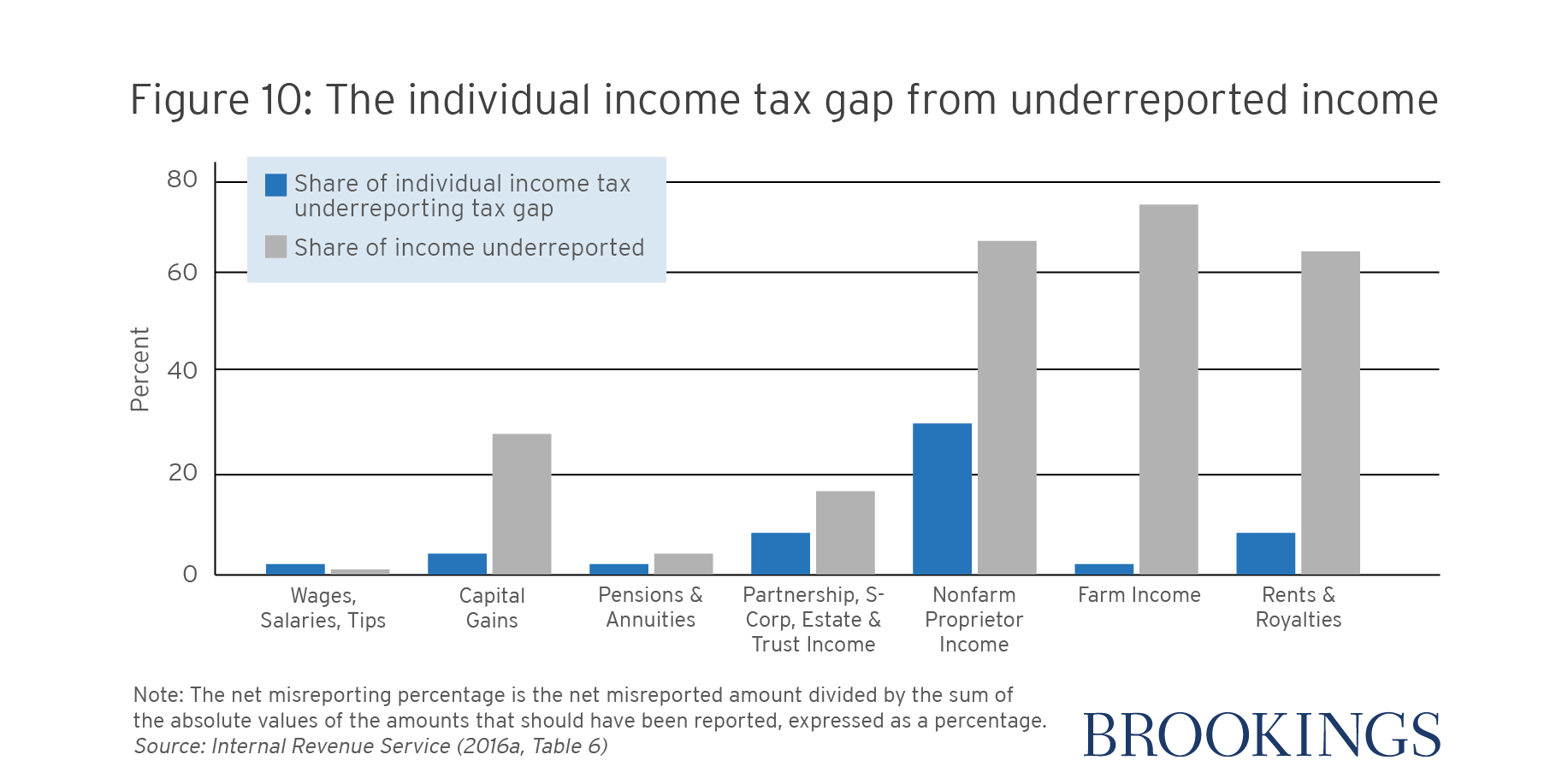

What S The Deal With Irs Tax Enforcement And The Federal Budget Foundation National Taxpayers Union

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

Seismic Shift In Pass Through Entity Valuation For Irs Reporting Marcum Llp Accountants And Advisors

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Pass Through Entity Definition And Types To Know Quickbooks

Qbi Deduction Provides Tax Break To Pass Through Entity Owners Cpa Firm Tampa

Single Member Limited Liability Companies Internal Revenue Service

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

21 10 1 Embedded Quality Eq Program For Accounts Management Campus Compliance Field Assistance Tax Exempt Government Entities Return Integrity And Compliance Services Rics And Electronic Products And Services Support Internal Revenue Service